Options Trading Books – Recommended Reading

It enables you to open a position using margin a deposit while still getting full exposure to an underlying asset. Your capital is at risk. Each market has its own set of rules, trading hours, and strategies, offering a range of opportunities to match different trading preferences and risk profiles. The extent to which a position can be marked to market daily by reference to an active, liquid two way market;. Central banks also control the base interest rate for an economy. IG Group established in London in 1974, and is a constituent of the FTSE 250 index. Activities which generate revenue for the business, such as Sales of Services or Goods, Closing Stock, are shown on the credit side Right. TradeStation was an early disruptor in the online brokerage business by offering a suite of professional quality tools to individual investors. You can provide constrictive criticism, but outright being an asshole doesn’t belong here. Therefore, learning how to trade in the stock market requires that you have a trading plan instead of just jumping on various bandwagons. Scalpers will try to gain overall profits from multiple small trades by opening and closing tens, or even hundreds, of positions per day and tend to aim for larger trade sizes that can benefit from small price movements or by including leverage to control larger volumes. 20 is charged per executed order in intraday. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. This means that for every $1,000 in your account, you can trade up to $100,000 in value. Benefits: i Effective Communication ii Speedy redressal of the grievances.

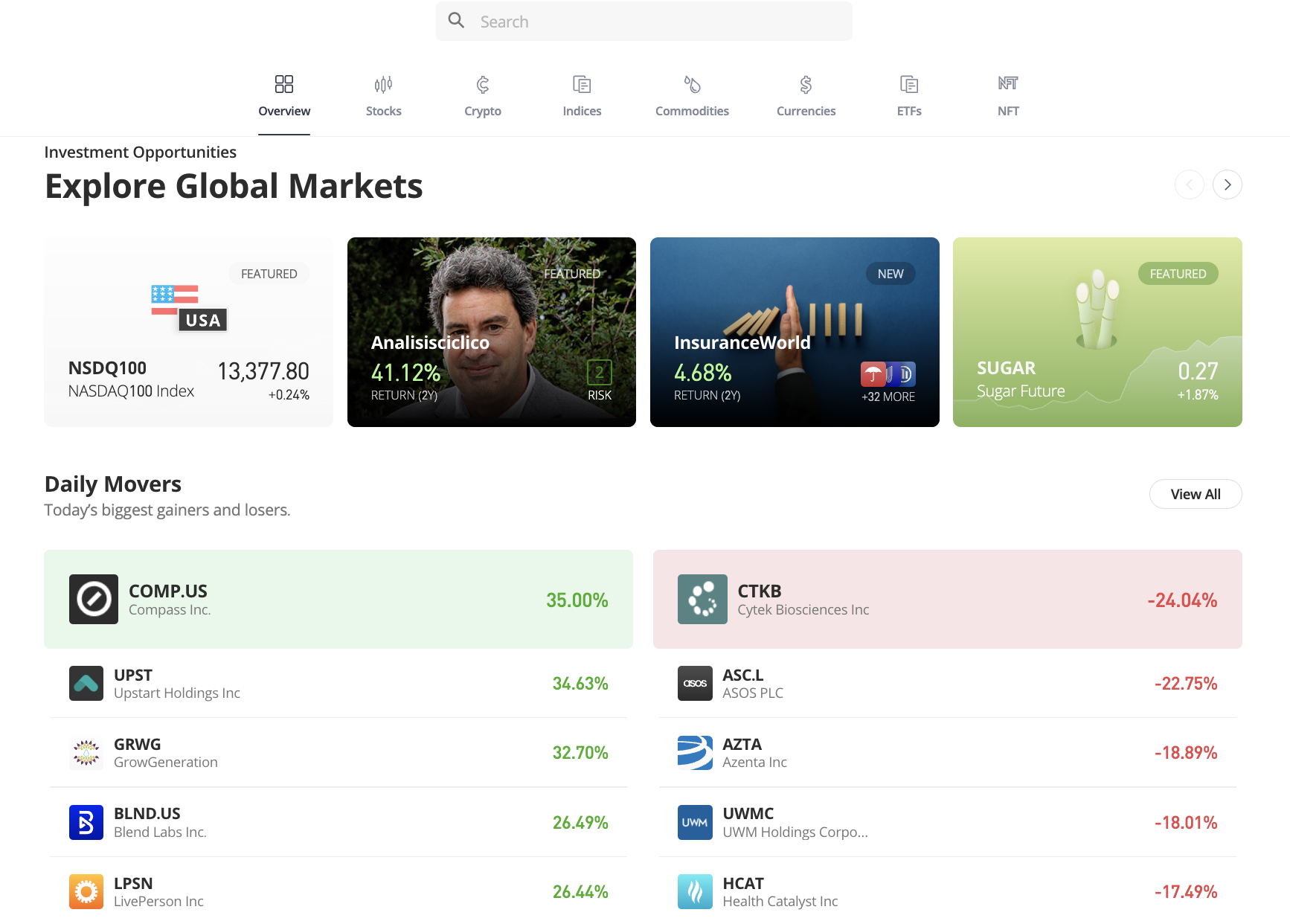

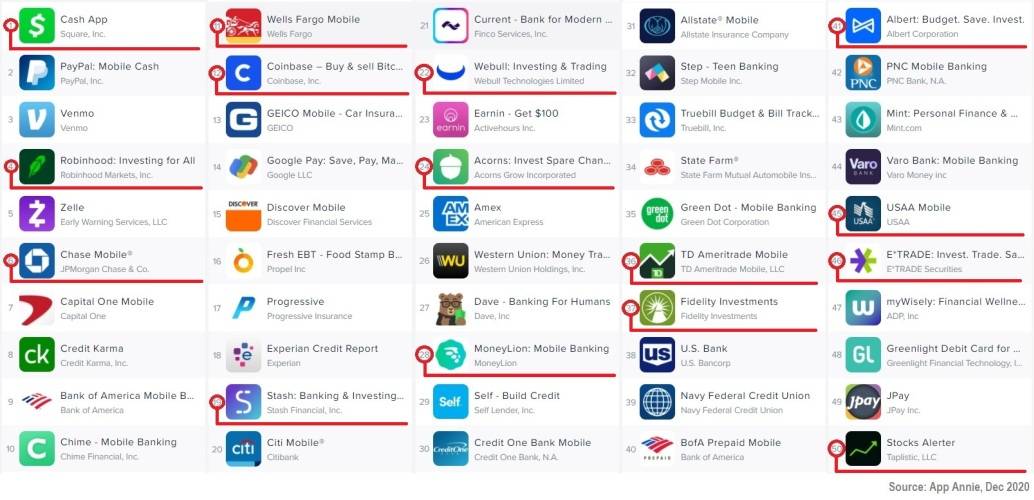

What other apps and tools are useful for crypto investors?

Initial profit targets are set at the lowest low or highest high of the pattern. IG is a trading name of IG Trading and Investments Ltd a company registered in England and Wales under number 11628764, IG Markets Ltd a company registered in England and Wales under number 04008957 and IG Index Ltd a company registered in England and Wales under number 01190902. Here are my top trading platform picks for online stock trading. If a brand is a referral partner, we’re paid when you click or tap through to, open an account with or provide your contact information to the provider. For those interested in algorithmic trading, Pepperstone supports various APIs, allowing traders to create, test, and implement their trading algorithms seamlessly. He heads research for all U. Podcast Editing: Some people thrive doing podcast interviews, but they can’t navigate the editing process. Schwab now houses the most comprehensive library of evergreen learning materials, along with seemingly endless coaching programs and regularly scheduled live training events, making it the best for beginner investors. Free Account OpeningFREE Intraday Trading Eq, FandO. Most people will want to use an online broker to buy and sell stocks. Margin investing involves the risk of greater investment losses. Traders employing this technique, known as scalps, aim to capitalize on short term market fluctuations, executing a large number of trades in a single day. With us, you can use our CFDs to take a position on bitcoin prices. As mentioned above, a trader has a number of options when it comes to trading in the equity https://pocketoption-ru.online/viewtopic.php?t=206 market, including investing via a shareholder or investment fund. With IG DealerLudwik Chodzko Zajko. Up to 5% back on all spending.

Great! The Financial Professional Will Get Back To You Soon

So, the transaction happens between issuers and buyers. But as these schemes are related to market risk, one needs to be careful before investing. Finally, as you embark on your trading journey, remember that learning is a continuous process. Learn the patterns of accumulation buying, distribution selling, and stalemate sideways action, and you’ll be well on your way to exploiting opportunities. He holds two of the most widely recognized certifications in the investment management industry, the Chartered Financial Analyst and the Chartered Market Technician designations. The following table highlights the differences between scalping and intraday trading. Charting on the IG Trading app is also rich with features. With the right coding and UX skills, you could work as a freelance app developer. To cover the basics on swing trading, visit what is swing trading. Once the momentum dies down, it’s time to sell. I’ve found the most effective way to learn is by doing, but learning often means making mistakes, which can be a deterrent to trading when real money is at stake. Measure content performance. Customers should consider the appropriateness of the information having regard to their personal circumstances before making any investment decisions. This platform offers a solid range of coins with very competitive trading fees. For the purposes of this example, the previous day’s EMA is i. Registered Office Address: Sharekhan Limited, The Ruby, 18th Floor, 29 Senapati Bapat Marg, Dadar West, Mumbai 400 028, Maharashtra, India. Once the stock made a golden cross, it really never looked back before launching yet again in June of 2021. For example, a trader with a low salary and net worth, little trading experience, and only concerned about preserving capital generally would not be permitted to execute high risk strategies like naked calls and naked puts. A Red Ventures company. Stock chart patterns often signal transitions between rising and falling trends. Benefits: Effective Communication, Speedy redressal of the grievances. No indicator can guarantee 100% accuracy, but Bollinger Bands are a valuable tool for assessing market volatility. Plus500 also offers a mobile app, allowing beginners to trade conveniently on their smartphones or tablets. Pay later with marginal trading option. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Here are four brokers or trading platforms that are worth considering for beginners in the U. It’s a great idea to learn about investing, it can only help with your future finances. The platform supports a hundred plus brokers, offering flexibility for diverse trading preferences. Through insightful interviews, Schwager uncovers the diverse trading strategies and approaches that propelled these individuals to market wizardry.

Traditional Trading Business Ideas:

All content on ForexBrokers. Our reviews were conducted using the following devices: iPhone 12 Pro, iPhone 15 Pro Max, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro. Once you’ve found what you’re going to trade, then it’s time to execute the trade. Robinhood and Webull are often thought of as being similar investing platforms. One of the key advantages of algorithmic trading is its ability to analyse large amounts of data and make decisions based on predefined rules. The account also automatically sets aside 30% of your portfolio as cash to protect you against market volatility. Was wondering what you think about the AnchorUSD app – some friends have downloaded and purchased some crypto with it recently and I am mulling options. The Charles Schwab app allows you to take your trading account data on the go—such as checking the balance for your checking account, savings account, retirement account, and brokerage account. Some platforms offer integrated wallets with features like multi signature support and private key control. Investment apps are safe for beginners and investors of all skill levels when they and partner banks are SIPC and FDIC insured. The Standing Senate Committee on Banking, Trade and Commerce examined the CBCA insider trading provisions in its 1996 report Corporate Governance. Short term trading has its own share of setbacks, just like any other career—perhaps more so due to the volatile nature of markets. For most people, online trading especially day trading won’t outperform buying a diversified index fund and holding it for many years.

FinTech Advisory Committee and related groups

The TD Ameritrade thinkorswim platform was, in fact, originally launched as a desktop only tool, which you can still use alongside the mobile application. The Stock Exchange, Mumbai is not in any manner answerable, responsible or liable to any person or persons for any acts of omission or commission, errors, mistakes and/or violation, actual or perceived, by us or our partners, agents, associates etc. An investor could potentially lose all or more than the initial investment. The importance of identifying both uptrends and downtrends lies in the following aspects. But what are you going to do if you have trades open and your internet connection goes down or your PC decides to self destruct. Forex trading can also be a lucrative investment opportunity. Intraday traders choose stocks with high liquidity and high trading volume. This will be a mock drill to ensure that everything works smoothly in the event of a disaster. Traders should consider their individual trading style, preferences, and goals when incorporating tick charts into their strategies. Absolutely Not, Users will have to mandatorily enter the login id and password on daily basis in their respective brokers portal while logged into Algomojo platform. Lukeman’s insights offer a deeper understanding of market mechanics, order flow, and liquidity, allowing traders to make more informed decisions. The holder of an American style call option can sell the option holding at any time until the expiration date and would consider doing so when the stock’s spot price is above the exercise price, especially if the holder expects the price of the option to drop. Users can engage in both delivery and margin trading through the app. In parallel to stock trading, starting at the end of the 1990s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. Such a composite tapestry of signals from these essential indicators for option trading can guide traders through the labyrinth of market volatility. Pattern day traders must maintain a minimum account balance of $25,000 in cash and eligible securities. While traders have the freedom to choose their tick values, many find Fibonacci numbers, such as 144, 233, or 610, to be effective intervals. Moving averages smooth out price data over a specified period, making it easier to identify trends and potential reversals. Why Merrill Edge® Self Directed made the list: Merrill Edge® Self Directed is one of our top free stock trading apps for a few reasons, and that’s especially true if you’re already a Bank of America customer Merrill Edge’s parent company. There are also some basic rules of day trading that are wise to follow: Pick your trading choices wisely.

Where Should We Send Your Answer?

As an intermediary to both sides of the transaction, the benefits the exchange provides to the transaction include. The 1 hour, 4 hour and daily time frames tend to provide a good balance between seeing the overall market structure and spotting potential trade setups. It is a well known fact in the stock market that the higher the reward, the higher the risks associated with it. Swing Traders are active for a few hours each day and do not spend the entire day shackled to their computers. Commission fees, although relatively lower in recent years, can accumulate quickly with the high volume of transactions typical of day trading. Bajaj Financial Securities Limited or its associates may have received compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months. After establishing a risk adjusted portfolio, users can compare other options with greater or lesser risk profiles that include a different mix of riskier stocks and more conservative bonds. Manage Live Positions. Three Outside Down Pattern.

1 Minimize market impact

Its very helpful software for a layman like myself, with a user friendly interface and fantastic functions, as well as constant notifications even when I’m not using the app. Once that is done, choose one of the provided templates or set up the bot’s parameters from scratch. This is known as going long or short. The credit institution or financial institution shall notify FI of its intention to delay the disclosure. Let’s say, you trade a stock. This is then transferred to the Profit and Loss account. About Appreciate online stock trading app. Film City Road, A K Vaidya Marg, Malad East, Mumbai 400097. The traders interviewed had confidence in their approach of winning over the long term, so did not have a problem with admitting they were wrong and taking losses along the way. 2Capital requirements for term trading related repo style transactions are the same whether the risks arise in the trading book as counterparty credit risk or in the non trading book as credit risk. A call option to buy $10 per point of the FTSE with a strike price 7100 would earn you $10 for every point that the FTSE moves above 7100 – minus the margin you paid to open the position. Did you try calling them to see what is taking so long to figure out your issue. No fees to buy fractional shares. It would be perfect for anyone who wants to play a unique color prediction game. The resulting solutions are readily computable, as are their “Greeks”. The rectangle patterns were first documented in the early 20th century by Charles Dow and other technical analysis pioneers. Or are you more laid back and happy to wait for long term results while prices move around. As with most leading robos, you’ll be presented with a suite of premade portfolios that aim to match your risk tolerance and are stuffed with low cost funds. There are a few benefits we like to look for when comparing free stock trading apps. As such, you must develop a disciplined trading plan, apply your risk management strategies, and avoid making impulsive decisions based on fear or greed. Overview: Goa Games offers competitive rewards and a vibrant gaming community, ideal for enthusiasts seeking higher bonuses. IBKR’s SmartRouting not available to IBKR Lite clients. What You Need: Knowledge of food rules, good suppliers, storage spaces, packaging, and marketing plans. 03% or INR 20 per executed order whichever is lower. The table below illustrates some of their most compelling quotes that elucidate the essence of disciplined trading. IPO Financing is done through Bajaj Finance Limited. If you are a Bajaj Broking customer, adding funds is simple with all available fund addition modes. Aspiring commodity market participants should always refer to the official websites of the respective exchanges for the most accurate and up to date information on trading timings.

Where can I find tutorials and guides for TradingView?

While a demat account helps you store securities in a dematerialized form, a trading account is instrumental in facilitating seamless transactions. My testing uncovered some interesting differences in both the user experience and features such as ease of use and the available trading tools which I’ll break down below. How can I get started trading FX. The point and click style execution through the Level 2 window or pre programmed hotkeys is the quickest method for the speediest order fills. Measure advertising performance. Our editors are committed to bringing you unbiased ratings and information. His expertise in the industry allows him to be an ASU Barrett Honors College instructor in personal finance. Com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. For a contract with a strike price of $100, the owner of a call would need $10,000 to exercise. A candlestick is a way of displaying information about an asset’s price movement. Plus500 is a trademark of Plus500 Ltd. It is important to trade at a size that does not have a material effect on your account if you are wrong. That lets you get started with just a few dollars. I’m not looking to avoid laws etcetera but, I’m a newbie so go easy isn’t an appeal of crypto to be anonymous from major governments. Before you start trading, it’s important to familiarize yourself with the basics of candlestick patterns and how they can inform your decisions.

How to start trading

Stock Market Wizards is the third in the bestselling Market Wizard series. Here’s a breakdown of the timings for trading in commodities on the MCX. Our recommendation: use ETRADE mobile for stock trading and Power ETRADE Mobile for options trading. This https://pocketoption-ru.online/ involves evaluating fees, platform capabilities, and support services. First published in 2000, it foreshadowed the 2008 financial crash and continues to serve as a reminder of what can happen when complacency enters a trader’s mindset. That’s fine if they understand the risks and know what they’re doing, less so if they don’t. Here’s a to do list to get you started. 5 minute charts will be correct; however, a Tick Chart constructed using IB data will not. But over time, Robinhood has improved the offering, bringing its incredibly easy stock user interface to crypto markets. Select the most appropriate alternative from those given below and rewrite the statement. This indecision in the doji pattern is reflected in the opening and closing prices being almost identical, resulting in a candlestick with an extremely small or nonexistent body. No promotion available at this time. The basic idea of scalping is to exploit the inefficiency of the market when volatility increases and the trading range expands.

Quick Links

In this respect, podcasting may end up being more of a marketing platform than a business. For instance, if the 50 day MA crosses above the 200 day MA, it signals an uptrend, which traders call a “Golden Cross. Issued in the interest of investors. Fibonacci retracement levels originate from the Fibonacci sequence. This risk demands close attention, and day traders must stay aware of new and current events in the volatile country. The membership is $5 a month, giving you unlimited access to stories on Medium. It also supports a handful of cryptocurrencies, like bitcoin and ether. When combined, advanced invoicing and dealing capabilities help us streamline the most complex part of accounting. Their strategy lies in a big number of small trades. See NerdWallet’s roundups for the best brokers for beginners. The ideal option for you if you are confident in your trading knowledge and abilities is a Premium Account. There are ‘hard’ and ‘soft’ commodities. Learn to spot signals, understand short squeezes, and boost your trading success. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Content creators are allowed to post but must follow these guidelines. Market volatility, volume, and system availability may delay account access and trade executions. The Ameritrade app was my favorite with respect to viewing my portfolio. FxPro competes among the top MetaTrader brokers, featuring multiple account options and various execution methods. Fidelity research gallery. With all due respect MT4 Mobile is long over due for an update. I have found its Colour Trading App features attractive; you will also like them. Attach your entry or exit orders to alerts so they are automatically executed when your alert is triggered. A day trader uses a timeframe of 1 2 hours, and a scalp trader uses a timeline of 5sec 1 min. Use limited data to select content. When choosing the best brokerage for you, you need to take a minute to assess your needs. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed. Gain basic to intermediate Excel skills, review corporate finance and financial accounting concepts, and create comprehensive valuation models in an interactive setting, receiving personalized attention in small group classes. But Schwab now owns TD Ameritrade and thinkorswim, an industry leader for active traders.

Guide on How to Open a Trading Account with Share India

Start small: Begin with a small investment to get comfortable with the app’s functionality. Economic indicators such as interest rates, inflation, geopolitical stability, and economic growth can significantly impact currency prices. Trading on margin uses two key methodologies: rules based and risk based margin. Many financial experts suggest that 15% to 20% of after tax income should go to saving, investing and debt repayment. Such representations are not indicative of future results. Prior to Nison’s work, candlestick charting was relatively unknown in the West. We discuss this in our tutorial on dojis. The current urban fabric construction and fire safety needs, force the need for Firefighting and safety equipment. The setup is very smooth and KYC is lightning quick. We’ll do our best to contact you, although not an obligation, when your equity drops beneath 99%, 75% and 55% of margin, respectively. This account is created simultaneously with a demat account. This report is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. After the shooting star candle is formed, you initiate a short position on the break lower, risking the high of the shooting star candle. Not only does Schwab provide the right mix of usability, tools, education, and research to cater to its diverse customer base, but it does so across multiple top tier platforms. This is because MetaTrader4, which most Forex traders use when they start out, does not offer any other charts. A user friendly interface can greatly enhance your trading experience, especially if you’re new to crypto trading. This helps in setting an escape value for a crisis situation. VegaVega is the rate of change in an option’s theoretical value in response to a one point change in implied volatility. Scalping is purely based on technical analysis and short term price fluctuations. The investor adds a collar to an existing long stock position as a temporary, slightly less than complete hedge against the effects of a possible near term decline. It offers trading and investment opportunities in stocks, currency, commodities, and mutual funds. DISCOVER THE SMARTEST WAY TO INVEST TODAYThe next generation of investing is here: eToro’s innovative smart portfolios are ready made, fully allocated portfolios utilising cutting edge technology to pick the best performing assets while minimising long term risk. Such an approach requires highly liquid stock to allow for easily entering and exiting 3,000 to 10,000 shares. Develop and improve services. Users can compete in trading contests, earn virtual currency, and climb the leaderboard. If your prediction is correct, you’ll make a profit. When acquiring our derivative products you have no entitlement, right or obligation to the underlying financial asset. Already have a Full Immersion membership. The average of these payoffs can be discounted to yield an expectation value for the option.